We recognize that returning profits to shareholders is an important management issue, and our basic policy is to strive to return profits to shareholders by comprehensively taking into account retained earnings, performance levels, dividend payout ratios, and other factors so that we can provide a stable return of profits to shareholders over the long term.

| FY2021 | FY2022 | FY2023 | FY2024 | FY2025 | FY2026 (Expected) |

||

|---|---|---|---|---|---|---|---|

| Dividend Per Share(yen) | 1Q | - | - | - | - | - | - |

| 2Q | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| 3Q | - | - | - | - | - | - | |

| FY-End | 30.00 | 30.00 | 70.00 | 28.00 | 32.00 | 35.00 | |

| Total | 30.00 | 30.00 | 70.00 | - | 32.00 | 35.00 | |

| Amount of Dividends(million yen) | 933.0 | 933.0 | 2,178 | 4,356 | 4,939 | - | |

| Payout Ratio(%) | - | 48.7 | 31.0 | 40.2 | 41.0 | 40.8 | |

| Ratio of Total Amount of Dividends to Net Assets(%) | 4.6 | 4.7 | 9.3 | 14.1 | 13.2 | - | |

- In the event of the announcement of revisions to financial statements, etc., the information in this data will not be immediately reflected.

- The Company does not retroactively revise related indicators in the event of stock splits, etc.

*On October 1, 2023, the Company executed a 5-for-1 stock split of shares of common stock. - The frequency of updates may change due to changes in the format of financial statements.

The contents of this data are based on the financial statements.

Although every effort has been made to convert data for publication, please be aware that errors may still occur due to human falsification by third parties, mechanical defects caused by malfunctioning equipment, or other force majeure.

For more detailed information on financial results, please refer to the financial statements and other documents.

Shareholders holding 100 shares or more

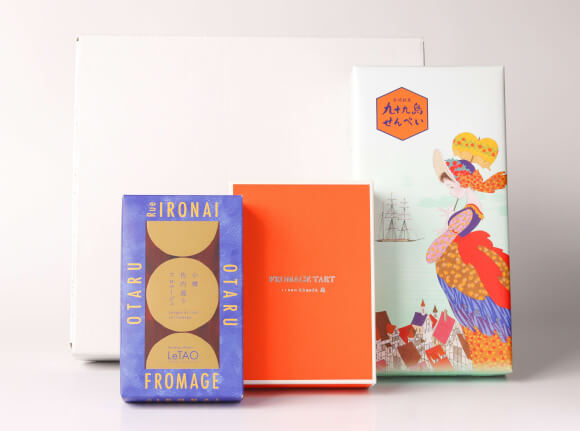

Group products worth 3,000 yen (flat rate)

*Photographs are of shareholder special benefit products for shareholders as of March 31 of this year.