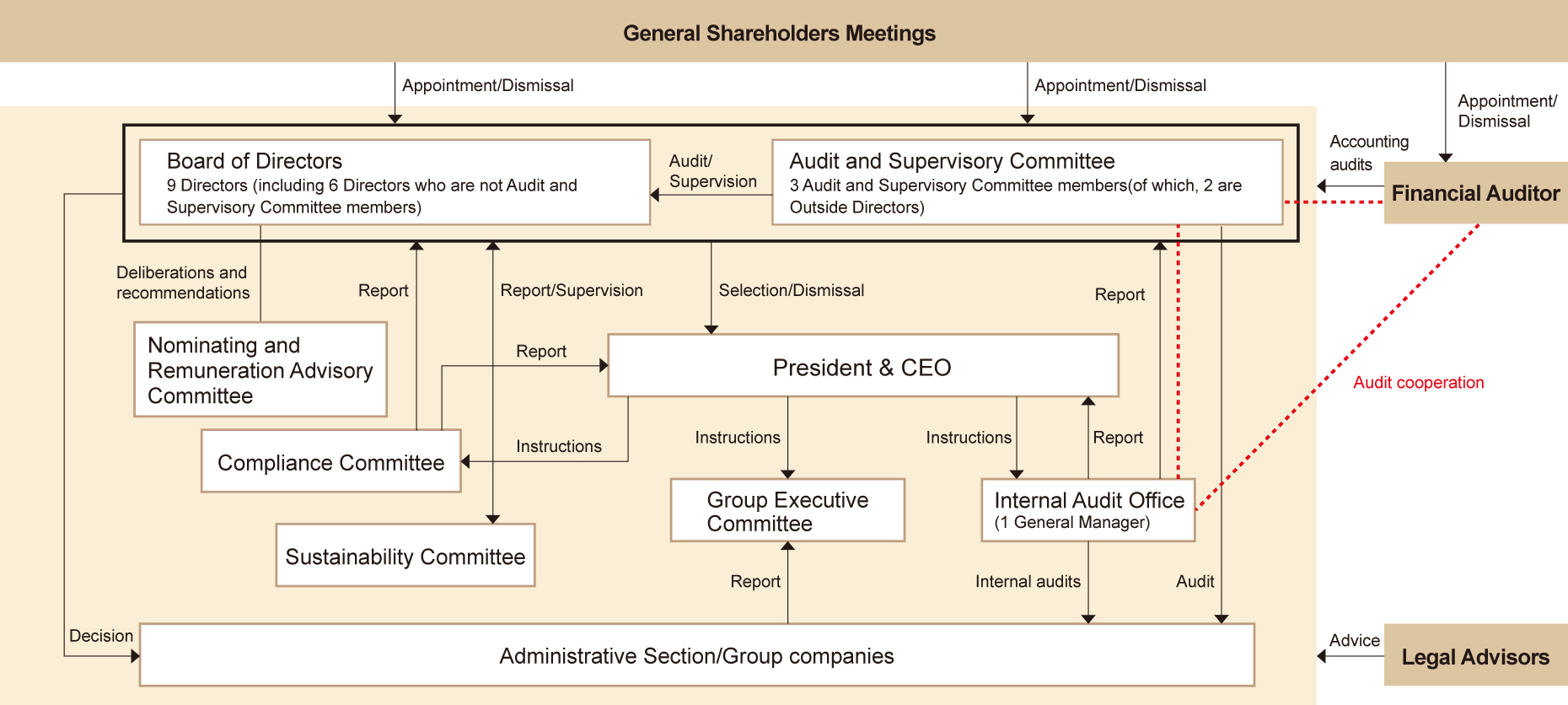

Corporate Governance Structure Chart (As of June 26, 2025)

The Board of Directors is chaired by Seigo Kawagoe, President and Representative Director, and consists of nine members: Shinji Matsumoto, Managing Director; Masayuki Jonouchi, Director; Ryoichi Sakamoto, Director; Matsuo Iwata, Outside Director; Megumi Yoshimoto, Outside Director; Michimichi Yamane, Director (Audit Committee member); Yasuhiro Tanaka, Outside Director (Audit Committee member); and Keiko Ueda, Outside Director (Audit Committee member) (including four Outside Directors). The Board of Directors consists of nine members (including four outside directors). The Board of Directors makes decisions on important matters related to business execution and supervises the execution of duties by directors in accordance with the "Regulations of the Board of Directors," which stipulates matters to be resolved at the Board of Directors meetings, in addition to those stipulated in the Articles of Incorporation and laws and regulations.

In order to ensure that directors execute their duties efficiently, meetings of the Board of Directors are held once a month in principle, and extraordinary meetings are held as necessary.

The Audit Committee, which is responsible for auditing the directors' execution of duties, consists of three members (including two outside directors): Director (full-time Audit Committee member), Mr. Michimichi Yamane; Outside Director (Audit Committee member), Yasuhiro Tanaka; and Outside Director (Audit Committee member), Ms. Keiko Ueda. In principle, the Audit Committee meets once a month to decide on audit plans and report on the implementation of audits, as well as as as needed. In addition to the Board of Directors meetings, the Audit Committee members attend important meetings such as the Group Management Committee meetings in order to understand the process of important decision-making and the status of business execution.

On June 22, 2021, the Company established a voluntary Nomination and Compensation Advisory Committee, consisting of a majority of independent outside directors, as an advisory body to the Board of Directors. The committee is chaired by outside director Matsuo Iwata and consists of six directors: two inside directors (Shinji Matsumoto and Rimichi Yamane) and three outside directors (Megumi Yoshimoto, Yasuhiro Tanaka, and Keiko Ueda). The Nomination and Compensation Advisory Committee receives requests for advice from the Board of Directors on matters related to the nomination and compensation of directors (including those of group companies), deliberates on such matters, and reports the results of its deliberations to the Board of Directors. In principle, the committee meets at least once a year, and may meet as needed.

On April 15, 2023, Minebea established the Sustainability Committee. The committee is chaired by Seigo Kawakoshi, President and Representative Director of the Company, and overseen by Shinji Matsumoto, Managing Director in charge of Administration of the Company, and consists of the managers of the administrative divisions of each Group company and members appointed from each Group company. In principle, the committee meets at least twice a year, and as needed. The basic policy of the Committee is to appropriately address issues related to sustainability, and the Committee deliberates on the identification of materiality and responses to the identified themes.

The Internal Audit Office of the Company consists of one person, Manabu Ashio, General Manager of the Internal Audit Office. The Internal Audit Office conducts internal audits of the Company and its group companies in accordance with the "Internal Audit Regulations" that stipulate basic matters concerning internal audits of the Company to ensure that business operations are properly and effectively managed under internal control in accordance with relevant laws, the Articles of Incorporation, and internal regulations. The Internal Audit Office is directly appointed by the President and Representative Director of the Company as an organization under the direct control of the President and Representative Director. The internal auditors have the authority to submit documents, request explanations and necessary information on the contents of the audits, and, if necessary, request confirmation from external parties.

The Compliance Committee is chaired by Seigo Kawagoe, President and Representative Director of Minebea, with Shinji Matsumoto, Managing Director in charge of administration, as the chief compliance officer, and consists of compliance committee members appointed from each Minebea Group company. Based on the "Compliance Regulations," which stipulate compliance initiatives, the Compliance Committee meets once every three months in principle to exclusively discuss compliance and corporate ethics training and education, responses based on the results of investigations of whistle-blowing and other reports through the whistle-blowing system, and measures to deal with the occurrence of risks in risk management. In addition, meetings are held as needed.

The Compliance Committee is attended and monitored by Director (Audit Committee member) Michimichi Yamane and Manabu Ashio, General Manager of the Internal Audit Department.

The Group Management Committee is chaired by Seigo Kawakoshi, President and Representative Director of the Company, and consists of Shinji Matsumoto, Managing Director, Masayuki Jonouchi, Director, Ryoichi Sakamoto, Director, and directors and managers of related divisions of each Group company. In principle, the meeting is held once a month to communicate group management policies, report on the business activities of group companies, and supervise the execution of business operations in accordance with the "Regulations for Affiliated Companies," which were established to promote the guidance and development of affiliated companies and improve management efficiency as a corporate group. We are working to ensure the efficiency, soundness, and transparency of management and to accelerate decision-making.

The Group Management Committee meetings are attended and monitored as necessary by Director (full-time Audit Committee member) Michimichi Yamane, Outside Director (Audit Committee member) Yasuhiro Tanaka, Outside Director (Audit Committee member) Keiko Ueda, and Manabu Ashio, General Manager of the Internal Audit Office.

We analyzed and evaluated the results of the "Questionnaire on the Effectiveness of the Board of Directors" conducted in May 2023 on all directors (including directors who are members of the Audit Committee) and based on discussions at the Board of Directors meetings. As a result, we evaluated that the Company's Board of Directors as a whole is generally effective at this time, as it has a good balance of knowledge, experience, and abilities to fulfill its roles and responsibilities, maintains an appropriate size, and makes decisions based on high quality and active discussions. As a result, the Company has evaluated that the effectiveness of the Board of Directors as a whole is generally secured at this point.

The Company will conduct an evaluation of the effectiveness of the Board of Directors about once a year, disclose a summary of the evaluation, and continue to make efforts to improve the effectiveness of the Board of Directors .

The Company's basic policy for determining the remuneration of individual directors is to set the remuneration at an appropriate level based on the duties and responsibilities of each director. The remuneration for Directors consists of basic remuneration (monetary remuneration) as fixed remuneration and restricted stock remuneration as a medium- to long-term incentive.

The basic remuneration of the Company's directors (excluding outside directors) is a monthly fixed remuneration, which is determined by taking into consideration the degree of contribution to the Company's performance according to position and responsibility, the level of other companies' performance according to years in office, the Company's performance, and the level of employees' salaries, as well as by comprehensively considering these factors.

Basic remuneration for outside directors is fixed monthly and is determined by taking into consideration their duties and responsibilities as well as the level of other companies.

Non-monetary compensation, such as restricted stock compensation, shall be paid to directors to provide them with incentives to continuously improve the corporate value of the Company and to further promote value sharing with shareholders.

The specific number of shares of restricted stock compensation to be granted shall be determined based on the position and responsibilities of each director, and the number of shares to be allotted to each individual director shall be resolved by the Board of Directors and granted at a certain time each year.

The amount of remuneration for each individual director is determined by the Board of Directors after deliberation and report by the Nomination and Remuneration Advisory Committee and prior discussion by the Board of Directors attended by the Outside Directors, based on a remuneration proposal prepared by the Representative Director within the maximum amount of remuneration for directors approved at the Ordinary General Meeting of Shareholders and based on the above policy and comprehensive consideration of the amount and ratio of base and non-monetary remuneration for each director. The Board of Directors, after receiving deliberations and reports from the Nomination and Compensation Advisory Committee and opinions from the Audit Committee, deliberates and decides the compensation plan at a meeting of the Board of Directors attended by outside directors.

With regard to the amount of remuneration for directors, at the Ordinary General Meeting of Shareholders held on June 28, 2016, the maximum amount of remuneration for directors (excluding directors who are members of the Audit Committee) is limited to 300 million yen per year (including 25 million yen per year for outside directors) and the maximum amount of remuneration for directors who are members of the Audit Committee is limited to 50 million yen per year within The Company has resolved that the maximum amount of remuneration for Directors who are Audit Committee members shall be no more than ¥50 million per year.

In addition, at the Ordinary General Meeting of Shareholders held on June 25, 2024, a resolution was passed to newly limit the amount of compensation to directors (directors excluding outside directors and directors who are members of the Audit and Supervisory Committee, hereinafter referred to as "subject directors") for the grant of restricted transferable shares to 60 million yen or less per year (excluding employee salaries for directors who also serve as employees), in addition to the above compensation limits. (However, the amount does not include the employee salary of Directors who also serve as employees). As of the end of the said General Meeting of Shareholders, the number of directors (excluding directors who are members of the Audit Committee) is six and the number of directors who are members of the Audit Committee is three.

Total amount of remuneration, etc. by director classification, total amount of remuneration, etc. by type of remuneration, etc., and number of directors subject to remuneration, etc.

|

Executive Classification |

Total amount of com-pensation, etc. (Thousands of yen) |

Total amount of remuneration, etc. by type (thousands of yen) |

Subject Number of direc-tors (persons) |

||

|

Fixed remuneration |

Performance-linked remunera-tion |

Lump-sum payment for re-tirement bene-fits |

|||

|

Directors (excluding audit committee members and outside directors) |

123,900 |

123,900 |

─ |

─ |

4 |

|

Directors (Audit and Supervisory Committee Members) (excluding outside directors) |

19,800 |

19,800 |

─ |

─ |

1 |

|

External Directors and External Corporate Auditors |

22,800 |

22,800 |

─ |

─ |

4 |

(Note) The total amount of remuneration, etc. for each director has been omitted because there is no director who is paid 100 million yen or more.

When welcoming outside directors, we provide them with opportunities to learn and understand information about the business environment in which we operate, such as our history, business overview, and plant tours of our group companies. In addition, in order to acquire the knowledge and information necessary to fulfill their roles and responsibilities, directors attend seminars held by outside professional organizations and participate in training sessions held by outside organizations. Audit committee members belong to the Japan Corporate Auditors Association, and participate in various training sessions held by the association to acquire the necessary knowledge and information to improve their auditing skills.

Our policy is to hold stocks that are judged to contribute to the enhancement of corporate value from the perspectives of maintaining and developing good business relationships and maintaining stable financial relationships, and to periodically review the medium- to long-term economic rationale and status of transactions at Board of Directors meetings with respect to highly important stocks. Based on this policy, the Company will seek to reduce the size of its holdings if they are not deemed appropriate. With regard to the exercise of voting rights, the Company exercises its voting rights appropriately, taking into consideration such factors as whether the voting rights contribute to the sound management of the issuing company and the enhancement of its corporate value over the medium to long term.

|

Identity |

Gender |

Post |

Skill |

|||||

|

Business Management Business Strategy |

Financial accounting |

Legal & Risk Management |

Human Resources and Labor Human Resource Development |

One's life as a consumer |

ESG |

|||

|

Seigo Kawagoe |

male |

In-house (full-time) President and Representative Director |

〇 |

〇 |

〇 |

|||

|

Shinji Matsumoto |

male |

In-house (full-time) Director |

〇 |

〇 |

〇 |

〇 |

〇 |

|

|

Masayuki Shirouchi |

male |

In-house (full-time) Director |

〇 |

〇 |

||||

|

Ryoichi Sakamoto |

male |

In-house (full-time) Director |

〇 |

〇 |

||||

|

Matsuo Iwata (Outside) |

male |

Outside (non-executive) Director (non-executive) |

〇 |

〇 |

〇 |

〇 |

||

|

Megumi Yoshimoto (Outside) |

female |

Outside (non-executive) Director (non-executive) |

〇 |

〇 |

〇 |

|||

|

Masamichi Yamane |

male |

In-house (full-time) Audit & Supervisory Board Member |

〇 |

〇 |

〇 |

〇 |

||

|

Yasuhiro Tanaka (Outside) |

male |

Outside (part-time) Audit & Supervisory Board Member |

〇 |

|||||

|

Keiko Ueda (Outside) |

female |

Outside (part-time) Audit & Supervisory Board Member |

〇 |

|||||

Reasons for Appointment of Each Director

|

Identity |

Post |

Reason for Appointment |

|

Seigo Kawagoe |

In-house (full-time) President and Representative Director |

He has directed the Company's management as President and Representative Director for many years since June 1994, and his strong leadership based on his extensive experience and broad knowledge will continue to be indispensable for the Company's group management in the future. |

|

Shinji Matsumoto |

In-house (full-time) Director |

Since joining the company, he has gained a wealth of business experience, including working in accounting and finance and as the general manager of the Corporate Planning Department. Since assuming the position of director in June 2012, he has fulfilled his responsibilities as a director, including working to strengthen group management control. We believe that the wealth of experience and broad knowledge he has gained through his career will be indispensable to the management of the Company's group. |

|

Masayuki Shirouchi |

In-house (full-time) Director |

Since September 2006, he has served as director of several of our group companies, and since 2015, he has also served as representative director of Kotobuki Seika Corporation, one of our major group companies. |

|

Ryoichi Sakamoto |

In-house (full-time) Director |

The Company believes that the extensive experience and broad knowledge he has gained throughout his career, including serving as director of several of the Company's group companies since May 2007 and as representative director of Shkrei Corporation, a major group company, since May 2019, will be indispensable to the Company's group management. |

|

Matsuo Iwata (Outside) |

Outside (non-executive) Director (non-executive) |

He has been involved in corporate management for many years, and we believe that he will be able to reflect on the Company's management from a neutral and objective standpoint by utilizing his abundant experience and broad knowledge as a manager cultivated through his career, and he is currently appropriately fulfilling his responsibilities as an outside director of the Company. |

|

Megumi Yoshimoto (Outside) |

Outside (non-executive) Director (non-executive) |

We believe that Ms. Kuroda will be able to reflect on the Company's management from a neutral and objective standpoint, based on her extensive experience and broad knowledge she has accumulated over the years as an announcer and as a lecturer and professor at several universities, as well as from her unique perspective as a woman. |

|

Masamichi Yamane |

In-house (full-time) Audit & Supervisory Board Member |

Since joining the company, he has been involved in labor and human resources, general manager of the General Affairs Division, and has abundant business experience. He became a director in June 2010, and has fulfilled his responsibilities as a director by working to strengthen the compliance and group management divisions. He was appointed to the Board of Directors in June 2010 and has fulfilled his responsibilities as a director by striving to strengthen the compliance and group management divisions. |

|

Yasuhiro Tanaka (Outside) |

Outside (part-time) Audit & Supervisory Board Member |

As a certified tax accountant, he has professional knowledge and extensive experience in finance and accounting, which we believe will be reflected in the Company's management from a neutral and objective standpoint, and he is currently fulfilling his responsibilities as an outside director of the Company who is a member of the Audit and Supervisory Committee of the Company. |

|

Keiko Ueda (Outside) |

Outside (part-time) Audit & Supervisory Board Member |

In addition to her legal expertise and wealth of experience as an attorney, she will be able to reflect on the Company's management from a neutral and objective standpoint, based on her unique perspective as a woman. |

For profiles of each board member, please refer to Company Profile.

In order to maintain fair and sound corporate activities, the Group establishes and operates various regulations, maintains appropriate systems for various organizations, and conducts accurate audits.

The Group's risk management is based on the audit work of the Audit Committee, regular accounting audits by the accounting auditor, internal audits by the Internal Audit Office, and regular meetings of the Compliance Committee, etc., to audit and supervise the status of business execution from an impartial perspective both inside and outside the company, evaluate the appropriateness and rationality of business activities, and make recommendations for improvement. The committee evaluates the appropriateness and rationality of business activities and makes recommendations for improvement.

The Group has established and is operating an internal reporting system that directly contacts the departments in charge of compliance, the administrative departments of each Group company, and our legal counsel for the purpose of preventing violations of laws and regulations and taking appropriate corrective measures upon early detection and measures to prevent recurrence.

|

Type of risk |

Risks |

counter-measure |

|

Due to abnormal weather conditions, large-scale disasters, etc. Rapid fluctuations in consumption trends |

The Group's core business deals in confectionery and other luxury goods, which, due to the nature of their uses and other factors, are subject to seasonal fluctuations and tend to be affected by weather fluctuations. |

|

|

natural disaster |

In the event of a major natural disaster that causes extensive damage to our business sites, resulting in long-term inoperability or other major disruptions to production or sales activities, or in the event that we are unable to sell products because we basically have a one-product, one-plant production system, with the exception of certain products, our group's business results may be affected. Therefore, the occurrence of products that can no longer be sold may have an impact on the Group's operating results. |

|

|

Food Safety |

Consumers are becoming extremely concerned about food safety. In addition, the confectionery and food industry is experiencing problems related to food quality and safety, such as mislabeling of food products and management of expiration dates and best-before dates for raw materials and products. |

|

|

Legal Regulations |

If the Food Sanitation Law, JAS Law, Food Labeling Law, Act against Unjusti-fiable Premiums and Misleading Representations, Unfair Competition Preven-tion Law, Product Liability Law, etc. were to be revoked or if we were ordered to suspend operations due to violations of laws and regulations, this could have a significant impact on the continuation of our group's operations and business performance. In addition, the Group's business continuity and op-erating results may also be affected in the event that business activities are restricted and operations are delayed due to the strengthening of regulations or the introduction of new regulations in the future. |

|

|

Procurement of raw materials and price hikes |

Confectionery ingredients consist mainly of many agricultural products such as flour, azuki beans, sugar, and oils and fats, which may be subject to price hikes and difficulties in stable procurement due to unseasonable weather in producing regions, the effects of natural disasters, or changes in global supply and demand conditions, and in the case of imported ingredients, purchase prices may also fluctuate due to exchange fluctuations. In addition, soaring crude oil prices may increase the prices of fuels such as heavy oil and petroleum products such as packaging materials and containers. |

|

|

Leakage of information |

In particular, since we hold personal information of many customers in our mail-order business, we comply with the Act on the Protection of Personal Information (hereinafter referred to as the "Personal Information Protection Law"), and we are committed to strict management of such information. However, in the unlikely event of an information leakage or an event that violates the Personal Information Protection Law for some reason, not only would we have to pay compensation for damages and incur response costs, but it could also seriously affect the credibility of our group and have an impact on our business performance. |

|

|

Overseas Business Development |

Our group is engaged in business activities, mainly in Asia, by exporting products and through local subsidiaries and franchise partners. Unexpected adverse economic or political factors, legal restrictions, or other events in the regions where we operate, such as earthquakes and other natural disasters, terrorist conflicts, or epidemics of infectious diseases, could impede our overseas business activities and affect our group's operating results. |

|

|

Impairment of fixed assets |

Our group owns various assets related to factories and stores used in our business activities. If impairment losses were to be recorded against subject assets due to a decline in profitability caused by significant changes in the business environment or business activities, future cash flows, or other factors, the Group's operating results could be affected. |

As of June 22, 2021, the Company established a voluntary "Nomination and Compensation Advisory Committee" consisting of a majority of independent outside directors as an advisory body to the Board of Directors to strengthen the supervisory function of the Board of Directors and enhance the corporate governance system. Based on its management philosophy, the Kotobuki Group has clearly stated its management philosophy (Philosophy) as the basis for all decisions (issued on January 1, 2003), and has also established the Kotobuki Spirit Group Code of Ethics and Compliance Regulations to clarify its basic stance on corporate ethics and legal compliance. We have also established the "Kotobuki Spirits Group Code of Ethics" and "Compliance Regulations" to clarify our basic stance on corporate ethics and legal compliance, and have ensured that all directors, officers, and employees are fully aware of them. In addition, we have established the "Compliance Committee," a cross-functional group-wide organization, to develop, maintain, and improve our compliance system.

The Minebea Group emphasizes stakeholder engagement through communication with various stakeholders to provide feedback to management on their opinions and expectations, and to apply them to management and corporate activities. We are committed to contributing to the realization of a sustainable society through ongoing proactive communication.

Relationship with each stakeholder

|

Stakeholder Relations |

corresponding means |

|

|

guest |

We believe it is our responsibility to deliver safe, secure, and high-quality premium gift sweets to our customers, and we pursue customer satisfaction. |

|

|

employee |

We will work on the penetration of our management philosophy, work-life balance, diversity, etc. so that we can demonstrate the "ultra field-oriented management," which is one of the strengths of our group. |

|

|

Shareholders and Investors |

To build a relationship of trust with our shareholders and investors, we place importance on communication and reflect the opinions and requests we receive in our corporate activities. |

|

|

Business Partners |

In our procurement activities, we will build relationships of trust with our suppliers and cooperate with them on the basis of coexistence and co-prosperity. |

|

|

local community |

As a member of the local community, our group will actively communicate with the local community to contribute to its sustainable development, and we will think about what our group can do and what is required of us, and walk together with them. |

|

The policy regarding the development of systems and initiatives to promote constructive dialogue with shareholders is as follows.

(i)IR activities of the Company are led by the President and Representative Director and the Director and General Manager of the Corporate Management Division.

(ii)Information on investor relations is handled by the Corporate Planning Department, the department in charge of investor relations, in cooperation with the relevant departments of the operating companies.

(iii)Our main IR activities include biannual financial results briefings, quarterly individual meetings with institutional investors and analysts, and the planning and operation of an IR site on our own website, which we strive to enhance by posting materials and videos of financial results briefings and general shareholders meetings on our IR site.

(iv)Opinions and other information obtained through IR activities are reported to the Board of Directors and the Management Committee as appropriate to share information.

(v)The Company appropriately and prudently manages insider information in the course of dialogue in accordance with the "Information Disclosure Rules" and the "Rules for Prevention of Insider Trading.